Sweatcoin Health Plans:

How We Discovered an $8M Hiding Opportunity

Sweatcoin is a Health & Fitness app that turns steps into currency, using rewards and gamification to drive user activity and retention with 150M+ users

Details

Project link

Check in App Store

Industry

Health & Fitness / B2C

Role

Design Director

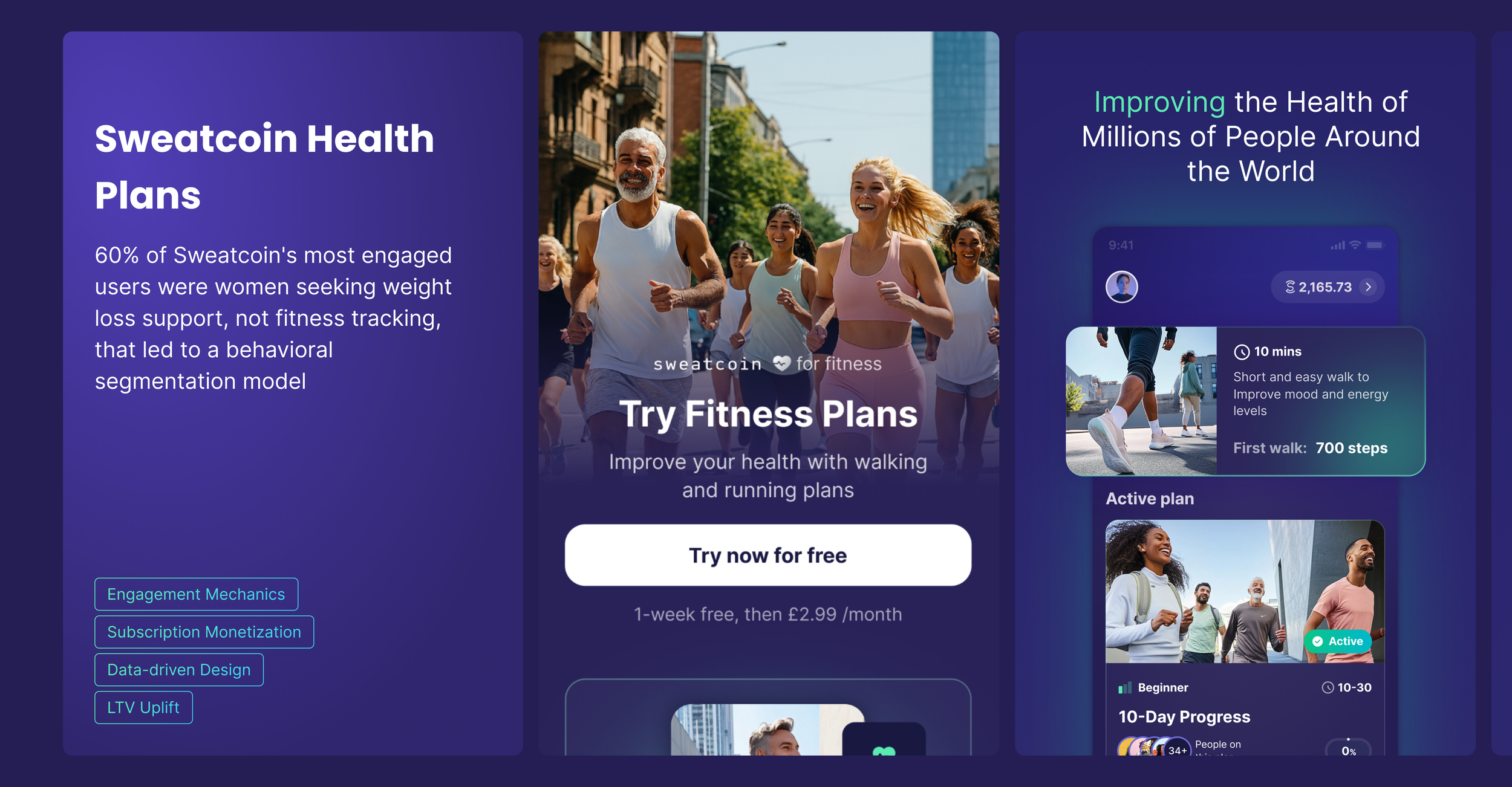

The $8 Million Surprise

With 150M+ users globally, our step-tracking app had massive reach, but our premium conversion skewed heavily toward already-active users, missing our largest engaged segment entirely.

The research revealed a stark misalignment:

60% of 456K Health Plans viewers were women seeking weight loss (35%) and mental wellness (21%) support

Our product is optimized for the 14% highly active users (9,000+ steps)

25% of engaged users were low-activity (<3,000 steps), predominantly women

Result: <2% conversion rate for our majority user base vs 14-48% for fitness-focused features

This wasn't just a feature gap. It was a fundamental product-market misalignment representing $8-12M in untapped annual recurring revenue.

Executive Summary

| Role | Design Director |

| Team | 3 direct reports (UX Researcher, Product Designers), cross-functional squad of 8 |

| Timeline | 6 months (left pre-launch) |

| Business Impact | Identified $8–12M ARR opportunity through behavioral segmentation of 150M users, transforming company-wide product strategy |

| Research Scale | 456K+ users engaged, 5.4K surveys completed, $200K investment with 40x ROI |

| Key Decisions | Simplified onboarding (89% completion), chose accessibility over innovation (80% task completion), prioritized by revenue per engineering hour |

"The women aren't here for fitness. They want to lose weight. They want to feel better. And we're giving them marathon training plans"

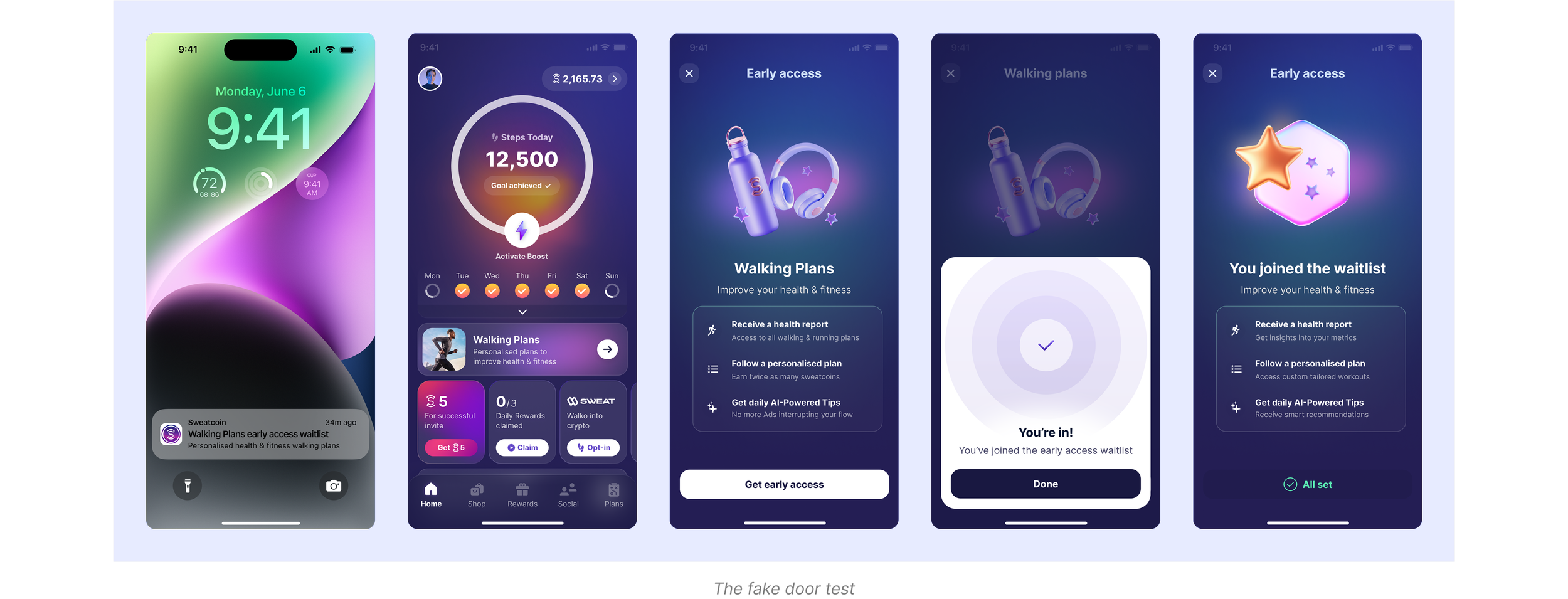

Our fake door test revealed the mismatch

The kicker: users clicking Health Plans were 3x more likely to pay for premium features. We'd accidentally discovered our highest-value segment, and we were completely ignoring them.

456,548 users saw our Health Plans teaser

42,366 clicked (9.2% CTR)

5,382 completed surveys telling us exactly what we were missing

Current state: 2% conversion on 150M users = $3M ARR

Opportunity: 5% conversion on targeted 60% = $12M ARR

Investment needed: $200K research + 6-month team

ROI: 20x in year one

The Business Case That Changed Minds

Leadership Approach

Design leadership isn't about having answers. It's about asking better questions

As Design Director, I reframed this from a feature request ("add health plans") to a strategic initiative worth 5-8% of company revenue:

Created a shared language: Our behavioral segmentation model gave everyone the same vocabulary

Set principles over features: We agreed on outcomes before debating solutions

Tied every decision to revenue: Showed that 1% conversion improvement = $1.5M ARR

Leading Through Ambiguity

Built cross-functional alignment

Led a team of 2 designers and 1 researcher within an 8-person squad

Guided designer's growth from UI execution to systems thinking (already on team)

Aligned competing priorities across Product, Data, and Engineering teams

Navigated organizational complexity

The product wanted speed. Data wanted proof. Engineering pushed back on flexibility.

Created alignment through behavioral segmentation model based on 5,382 survey completions

Defended critical scope decisions: kept personalization and progress visibility despite 30% engineering pushback

Managed $200K research budget across fake door tests, surveys, and user interviews

Set strategic direction through design principles

Outcome over output — Show health impact, not just step counts

Progress over performance — Reward consistency for inactive users

Flexibility within structure — Guided paths that adapt to real life

The Research That Changed Our Thinking

That quote from user interview #7 changed everything. We weren't building a fitness feature. We were building a behavioural support system.

What 5,382 Surveys Taught Us

Our "low activity" users (25% of base) were 67% women, taking <3,000 steps daily, with weight loss as primary goal. They had money to spend but nothing to buy.

| Segment | Size | Profile | Opportunity |

|---|---|---|---|

| Dormant | 37.5M (25%) | 67% women, <3k steps | Highest churn risk, untapped premium potential |

| Emerging | 67.5M (45%) | Mixed gender, 3–7k steps | Sweet spot for behavioral change |

| Active | 45M (30%) | Current premium base | Already monetized |

But here's what shocked us: the Dormant segment showed 3x higher engagement with reward features when they clicked Health Plans:

Daily Bonus participation: 48% (vs 14% baseline)

Super Draw purchases: 33% (vs 16% baseline)

Key Strategic Decisions

Research-Driven Pivot (Saved 3 months, $500K)

Decision: Killed our initial “performance plans” direction after fake door test (456K views → 42K clicks → 5.4K survey completions) showed 90% interest from inactive users

Impact: Avoided building for wrong audience, redirected to $8–12M opportunity

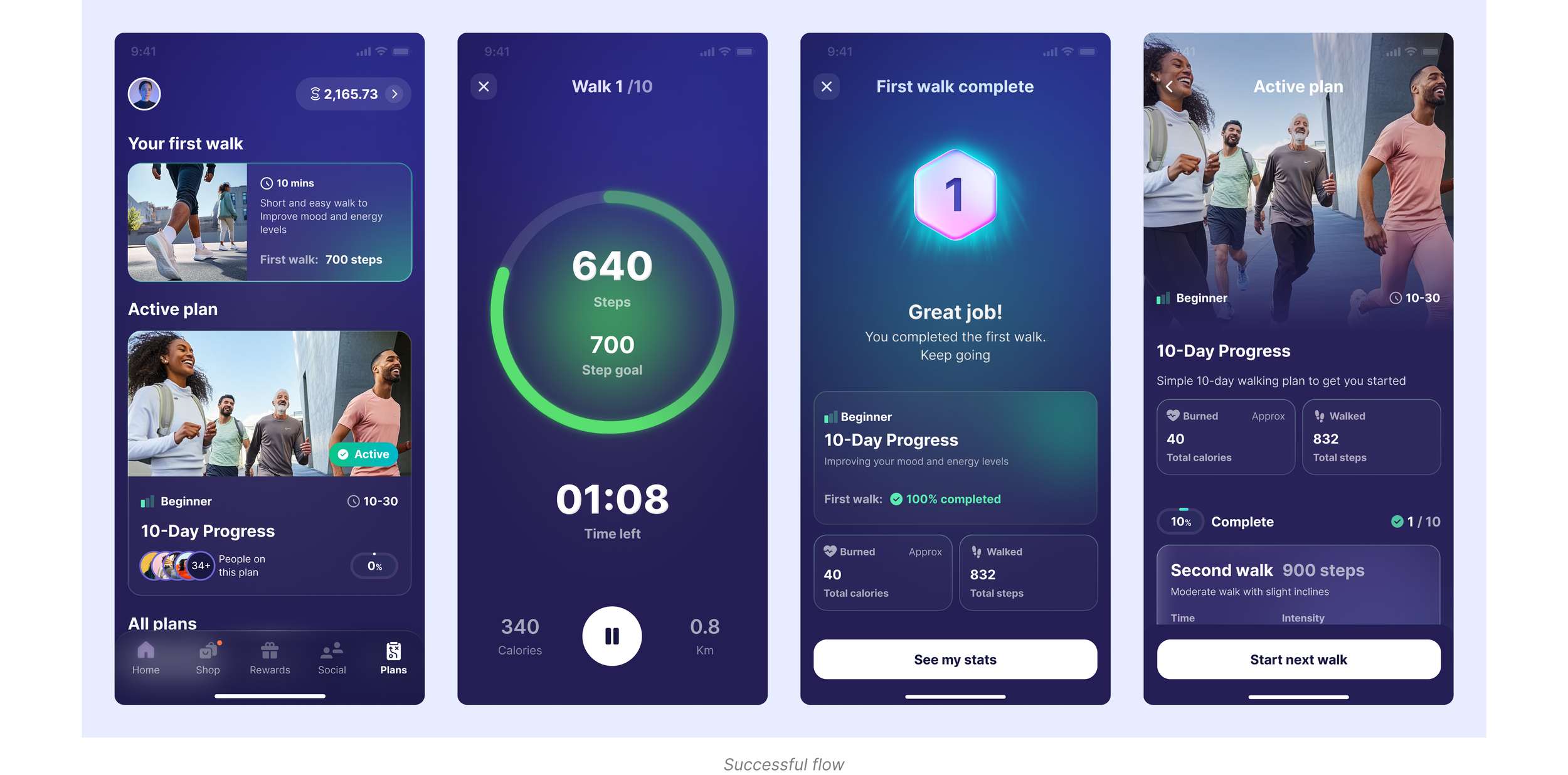

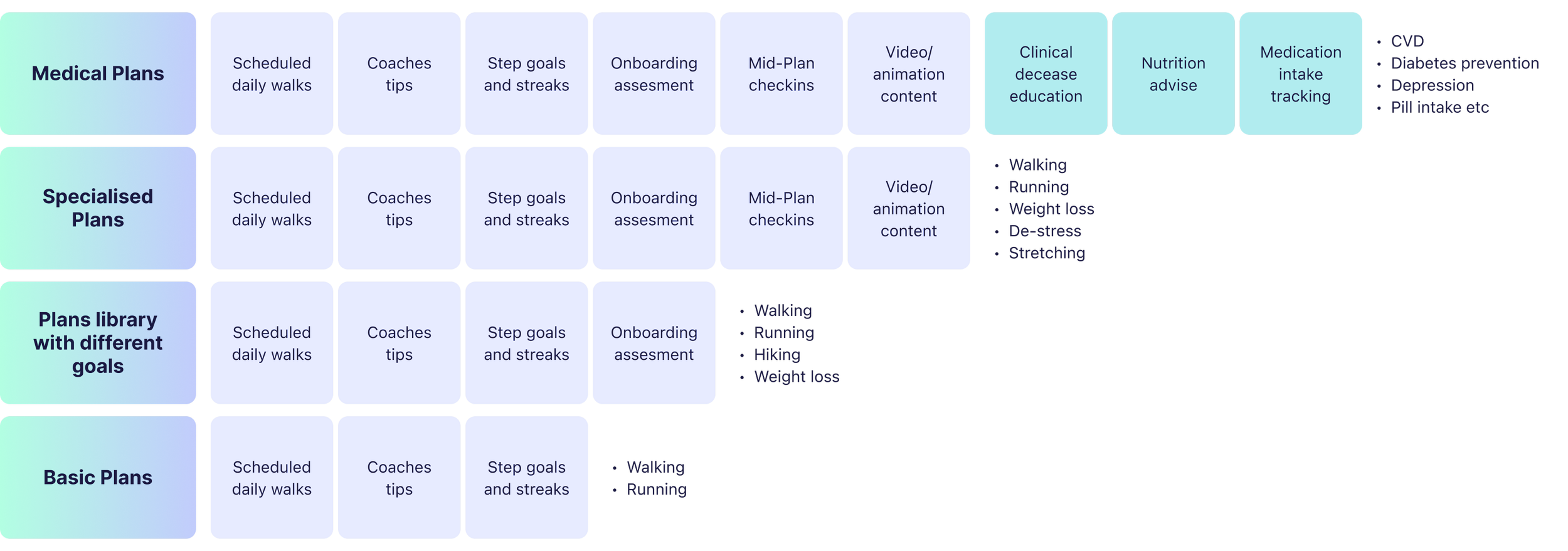

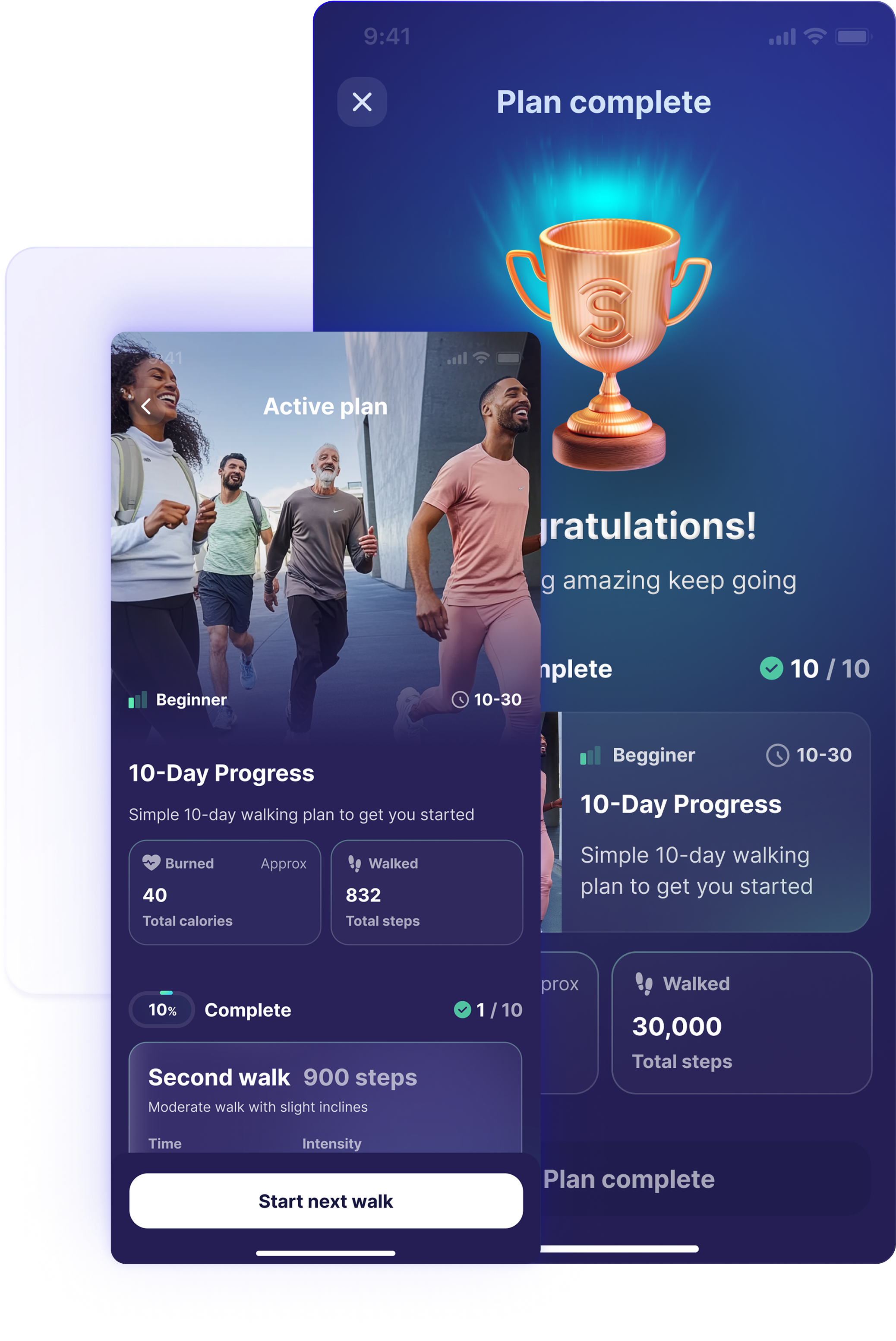

Tiered Architecture Framework

Decision: Designed modular plan system (Basic/Goal-Based/Specialized/Medical) vs. monolithic features

Structure: 10–45 day programs with daily goals, AI coaching tips, progress tracking

Example: “10-Day Starter Plan” – 132–468 cal burn, 10–30 min daily, beginner level

Value:

- Enabled 70% faster content updates post-launch

- Architecture adopted by Rewards and Challenges teams (impacting 40M+ MAU)

- Reduced engineering complexity by 40%

- Created foundation for 50+ plan variations without code changes

- Integrated with existing gamification (streaks, milestones) for 3x better retention

Behavioral Segmentation Model

Introduced company’s data-driven behavioral model based on 150M user base:

- Dormant (0–3k steps): 37.5M users (25%), highest churn risk, 67% women

- Emerging (3–7k steps): 67.5M users (45%), highest revenue potential

- Active (7k+ steps): 45M users (30%), current premium base

Youth Market Discovery

Finding: 20% of Health Plans interest came from users under 18

Value: Identified 30M+ underserved young users

Impact: Sparked new work stream for youth wellness features

These models now drive:

- Growth team’s $15M acquisition budget allocation

- Product roadmap prioritisation (Q1–Q2 2024)

- Marketing segmentation (3x improved CAC)

Building the Solution

The Critical Design Decisions

Not all design decisions happen in Figma. Here are the calls I made:

Simplicity Over Sophistication

We had built an AI-powered adaptive system that adjusted daily goals based on performance.

- Why? Our low-activity users needed confidence, not complexity

- The trade-off: Less "innovative" but more accessible

- Result: 80% task completion vs 35% in user testing

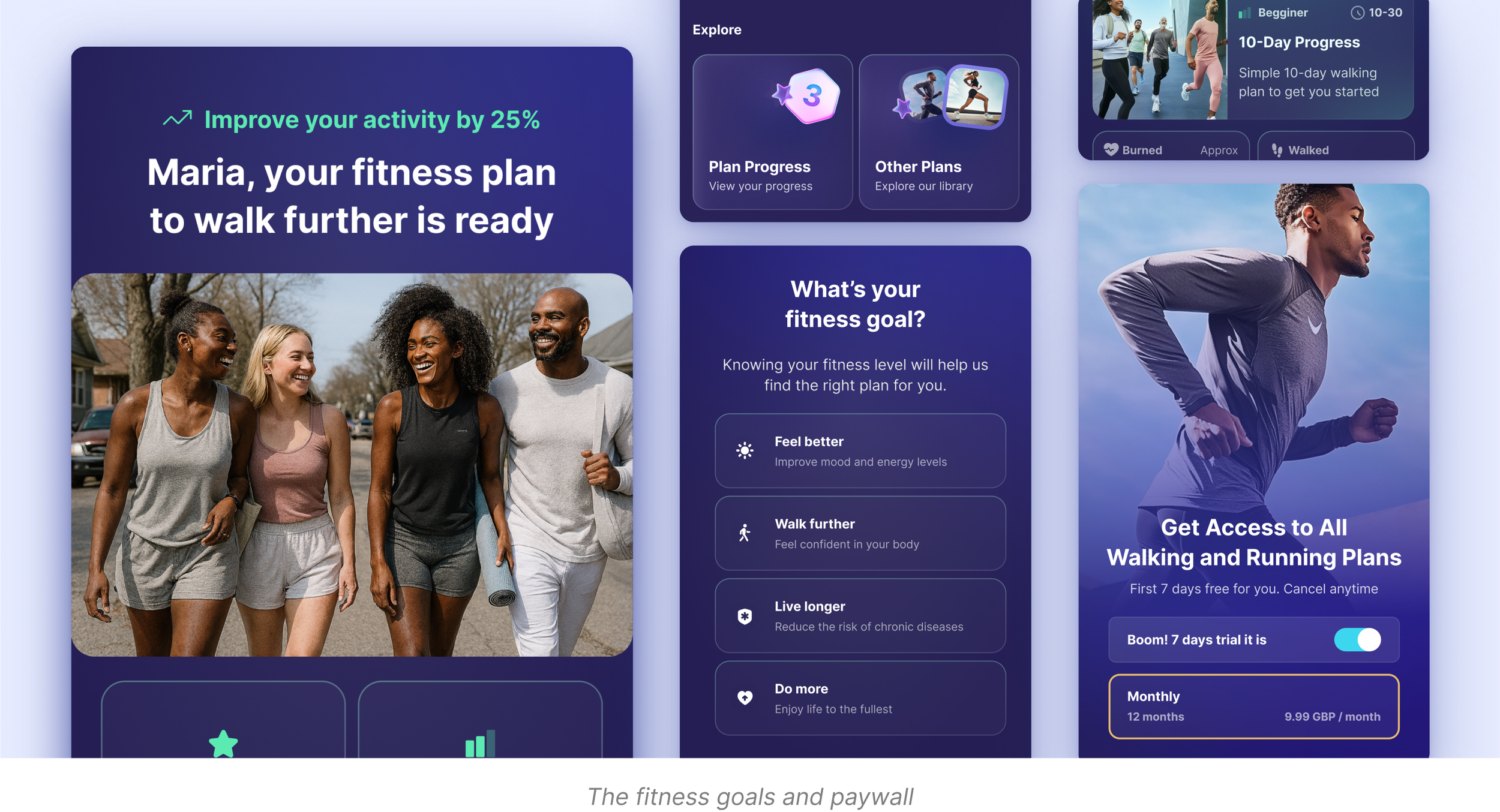

Free Value Before Premium Push

Against strong sales objections, basic plans are completely free.

- Why? Trust before transaction for vulnerable users (remember: 67% were women seeking weight loss support)

- The trade-off: Delayed monetization for higher LTV

- Result: 2.5x higher premium conversion after 14 days vs immediate paywall

One Persona, Not Five

Focused the entire MVP on "Emerging Emma" — our 45% segment. Ignored power users entirely.

- Why? Better to delight 67M users than dilute for 150M

- The trade-off: Built for not our most vocal (active) users

- Result: 48% engagement from target segment vs 14% baseline

The Onboarding Revolution

Reduced our onboarding from 8 screens to 1 question: "What’s your main goal?"

- Why? 65% drop-off rate was killing us before users even started

- The trade-off: Less data collection upfront

- Result: 89% completion rate, 3x higher Day-1 retention

The Framework

Each tier could support 50+ variations without engineering changes. The Rewards team adopted it within weeks and followed the behavioral framework.

Organizational Impact

Although Health Plans were deprioritized in Q4 2024 for other revenue initiatives, the strategic work transformed how Sweatcoin approaches product development:

Before my involvement

Features built on assumptions about "average" users

Design engaged post-requirements

No systematic approach to behavioral change

After

Behavioral segments drive all feature prioritization

Research partnership model adopted across 3 teams

Design principles framework used in 2024 planning

Specific wins

CPO referenced our tiered UX approach in the company all-hands

Research cadence I established became the org standard

PM team adopted our user segmentation for Q1 roadmap company

Research & Development Investment

The Health Plans initiative represented one of Sweatcoin's largest research investments:

Research Scale

456,548 users exposed to fake door test

5,382 completed surveys (multi-stage screening)

48,189 total survey interactions

20+ user interviews across 6 countries

3-month longitudinal behavior analysis

Team Resources

8-person dedicated squad for 6 months

$200K research budget

Cross-functional workshops with 25+ stakeholders

This investment validated the strategic importance and helped secure behavioral transformation approach.

Projected Business Outcomes

Working with finance and data teams, we established success metrics based on industry benchmarks and our user research:

| Metric | Industry Benchmark | Our Target | Revenue Impact |

|---|---|---|---|

| Premium Conversion | 12% (top health apps) | +5–10% lift from 2% base | $8–12M ARR |

| Trial-to-Paid | 30% (7-day free trial) | 35% target | £9.99/month LTV |

| Daily Active Users | +10–20% (with coaching) | +15% increase (7.5M users) | $3M ad revenue |

| 30-day Retention | 3–8% average | 10%+ target | Reduced CAC by 25% |

| Feature Engagement | 14% (challenges) | 48% (health plans users) | 3.4x reward spend |

Key insights

This correlation proved Health Plans users were our highest-value segment across all monetization vectors.

Users clicking Health Plans showed 2-3x higher engagement with reward features:

Daily Bonus: 48% participation (vs 14% baseline)

Daily Draw: 55% participation (vs 25% baseline)

Super Draw purchases: 33% (vs 16% baseline)

Team Development Impact

Beyond product outcomes, I focused on building lasting design capability

Researcher growth: Led first major initiative → invited to company strategy committee → promoted to Senior Researcher

Designer evolution: Shifted from "UI creator" to "systems thinker" → promoted 6 months later

Team efficiency: Streamlined design sprints, reducing concept-to-prototype from 3 weeks to 11 days

Research democratization: Created playbook now used by 4 other teams

Impact highlits

Users engaged

456K+

Opportunityy

$8-12M

Engagement

48%

What This Taught Me About Design Leadership

Looking back, Health Plans wasn't about the feature. It was about transformation.

The Real Job of a Design Director

See the bigger picture — We found $8M hiding in demographic data

Build the conditions for success — Systems over solutions

Develop people while delivering — The team's growth outlasted the project

Navigate politics with principles — Data ends more arguments than opinions

The Real Job of a Design Director

I'd push harder for a limited beta. Even 1,000 users on Health Plans would have proven the revenue model. Sometimes, perfect is the enemy of good enough.

I don't know if Health Plans will succeed when it launches. But I do know the company now asks different questions. Who are we really building for? What do they actually need? That shift in thinking — that's what matters.

Design Director / Sweatcoin